Markets and Prices: Pros, Cons

Posted on | February 23, 2025 | No Comments

Economists argue that using a money system with flexible prices is the best way to ration scarce goods and services in a society. They point to alternative approaches – lotteries, political or physical force, random assignment, and queues/lines – as seriously flawed distribution strategies. The specter of people in Communist countries lining up for their commodities provided compelling images and narratives supporting the price mechanism and the social dynamic that many people call “markets.” This post examines how markets emerged and what is valuable and detrimental about them. It discusses the underlying economic understanding of markets and includes several critiques of this term and our allegiance to them.

The term “market” evokes imagery of a medieval city center or town square filled with merchants peddling food or wares and haggling over prices with interested visitors and potential customers. It has achieved considerable circulation as the dominant metaphor for understanding the modern “free enterprise” economy.

For economists, markets refer to arrangements, institutions, or mechanisms facilitating the contact between potential sellers and buyers. In other words, a market is any system that brings together the suppliers of goods or services with potential customers and ideally helps them negotiate and settle the terms of a transaction, such as the currency and the price. But what are the downsides to our reliance on markets?

If you spell market backward, you get “tekram,” an interesting, if hokey, reminder that markets are social technologies and need to be created and managed. RAM or random-access memory is a computer term that signifies how much memory or “working space” you have available on your device. The more RAM, the more applications you can keep running simultaneously without losing significant speed. Likewise, markets need environments accommodating many participants and providing safe, swift, and confidential transaction capabilities without downtime or other technical problems. The more buyers and sellers, the better a market can work. Economists have begun recognizing that digital markets require attention to several conditions, including privacy, interoperability, and safety, to facilitate transactions and make a digital economy work effectively.

Characteristics of Markets

Economists have identified specific characteristics of the market phenomenon. For one, a market depends on the conditions of voluntary exchange where buyers and sellers are free to accept or reject the terms offered by the other. Voluntary exchange assumes that trading between persons makes both parties to the trade subjectively better off than before the trade. Markets also assume that competition exists between sellers and buyers and that the market has enough participation by both to limit the influence of any one actor.

Effective economic models of markets are based on the idea of perfect competition, where no one seller or buyer can control the price of an “economic good.” In this vision of a somewhat Utopian economic system, the acts of individuals working in their self-interest will operate collectively to produce a self-correcting system. Prices move to an “equilibrium point” where producers of a good or service will be incentivized or motivated to supply an adequate amount to meet the demand of consumers willing to pay that price. Unless someone feels cheated, both parties end the transaction satisfied because the exchange has gained them some advantage or benefit.

Central to any market is a mutually acceptable means of payment. A crucial condition is the “effective demand” of consumers – do the buyers of economic goods have sufficient currency to make the purchase? Consumers must desire a good, plus the money to back it up. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services (including labor) in exchange for currency from buyers. The system depends on a process of determining prices.

A media perspective on economics starts with media, which includes money and other symbolic representations that influence economic processes. Markets only function well with the efficient flow of information about prices, quantities, and the availability of goods and services. Buyers need to know what’s available and at what cost, while sellers need to understand what consumers are willing to pay. Information systems and media help reduce information asymmetry, where one party has more information than the other, which can lead to unfair or inefficient outcomes.

Media, in various forms, play a crucial role in disseminating this information. Traditionally, this involved newspapers, trade publications, and physical marketplaces. Today, digital media like websites, e-commerce platforms, and social media play a dominant role in conveying price information and connecting buyers and sellers. Consumers can compare prices, research products, and read reviews, while producers can track market trends, analyze competitor behavior, and adjust their strategies accordingly. Information systems and media then facilitate interaction by providing platforms for communication, negotiation, and transaction processing.

The Price System

How do prices decrease or increase? The quick answer is that companies adjust their price sheets. However, some companies have more pricing power than others, so let’s go through the economic arguments and explanations about prices.

Central to the process of economic exchange is the determining of prices. A price is commonly known as the cost to acquire something, although it is important to keep some distance between the words “price” and “cost.” Both have specific accounting meanings. In accounting, cost represents the internal investment made by a business to produce or acquire something, while price represents the external value exchanged with customers in the marketplace. Price is the money (or other currency) a customer or buyer pays to acquire a good, service, or asset.

Prices are the value exchanged to benefit from the good or service. Prices can be figured in monetary terms, but other factors like time, effort, or even foregoing other opportunities are often considered. Businesses need to set prices that cover their costs and generate a profit while remaining competitive in the market.

Buyers determine what value they will get from the purchase. While prices are ultimately a factor in the one-on-one relationship between a buyer and a seller, prices are determined within a social context.

Besides helping to reconcile the transaction between a buyer and a seller, a system of prices helps signal what is scarce and what is abundant. It helps gauge the demand for something and the incentives for producers to supply it. A price system allocates resources in a society based on these numerical monetary assignments and is, hopefully, determined by supply and demand.

Prices are influenced by society’s communication systems. They are negotiated within the confines of languages, modes of interaction, and the ability to be displayed by signage and posted on various media. Reuters created the first online market for global currencies in the 1970s by linking up computer terminals in banks worldwide. It was a time shortly after the US dollar went off the gold standard and global currencies were in flux.

They charged them to list their prices for various national monies and again for subscribing to the system. It was the early 1970s, so the numbers and letters were listed in old-style ASCII computer characters, and traders concluded deals over the phone or through teletype. However, having the prices of each currency listed by each participating bank created a virtual market. By the 1980s, digital technology was dramatically transforming the globe’s financial system, trading trillions of dollars daily in currencies and other financial instruments.

Amazon has a dynamic pricing system that changes the rates on thousands of products during a single day. Sellers can change the price of their goods through Amazon Seller Central or participate in a dynamic repricing system like xSellco or RepriceIT that automatically undercuts competitor prices. A seller can ensure that the amount will not incur a loss by setting a minimum price. If you’re a seller on Amazon.com, a critical factor for your online success is keeping your inventory priced right so it doesn’t stagnate or lose money. Innovations like Honey and Piggy provide free browser extensions that find better prices on Amazon and other e-commerce sites and apply coupons at checkout.

Economists consider allocating a society’s goods and services by price setting to be the most efficient system of rationing—the role of rationing increases when evaluations of scarcity emerge. The rationing process can be either price or non-price-based. However, the latter approaches, including lotteries, queues, coupons, force, or even sharing, impose additional costs such as waiting times and may result in black markets. The price system tends to be responsive but, as will be mentioned later, imposes other social costs.

Equilibrium and the Turn from Political Economy

In economic theory, a working and efficient market is based on prices converging. All the same items must have only one price. Otherwise, buyers will to continue to search for a better price or opportunities for arbitrage arise. In other words, items could be easily be purchased from the merchant offering the lower price or the product will be bought by middlemen and sold to another seller.

William Stanley Jevons, a Professor of Political Economy at University College London came up with the Law of One Price in the mid-19th century, but it goes more often by its contemporary formulation, the “equilibrium price” or the market-clearing price. When a good or service reaches such a price it will be attractive to for buyers to buy, and sellers to sell. Ideally, the market will clear, i.e., all customers will get the amounts of the product they are satisfied with and all items will be sold as the suppliers will be satisfied with the price as well.[1]

In Jevons’ Theory of Political Economy contributions, he helped separate modern “neoclassical” economics from political economy. With the one price formulation, mathematics replaced history as the central vehicle for constructing theories about economics by providing an internally coherent system for producing models of market processes and a logic for predicting human economic behaviors.

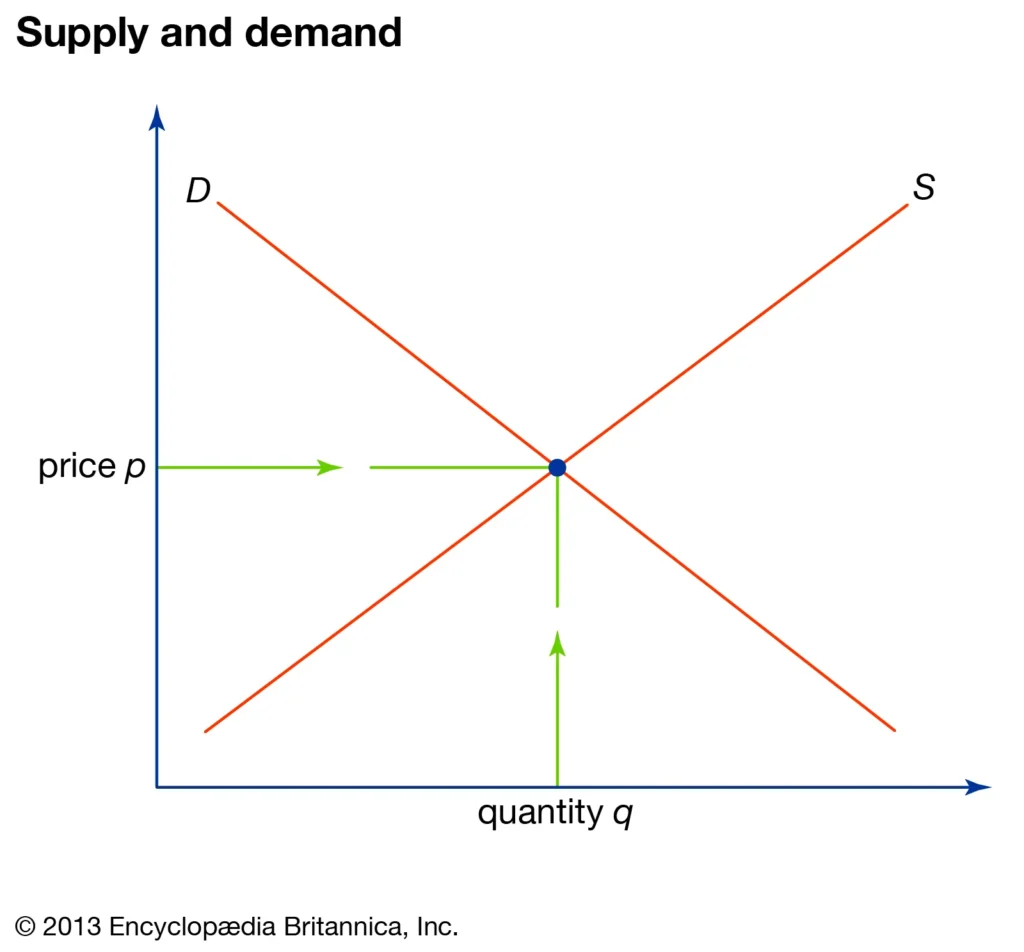

The reader should search the Internet for images of supply and demand charts while reading this section.

With the one price theory came a new emphasis on the supply-demand framework and graphs that allowed prices to be plotted and optimized. These graphs use supply and demand curves that describe the relationship between the quantity of goods or services supplied and demanded. They describe not just the equilibrium price but suggest how much of a good or service would be sold at various prices.

Alfred Marshall wrote the Principles of Economics (1890) and explained how the supply-and-demand logic could be graphed. He described supply and demand curves and how they connected to various prices, including the market equilibrium price. An increase in the price of a good is associated with a fall in the quantity demanded of that good and an increase in the amount that will be supplied by producers. As a product gets more expensive, less of it sells.[2]

Conversely, a decline in the price of a good is associated with an increase in the quantity demanded of that good and in a decline in the number supplied by producers. This last point is important, the lower the price of the good, the less incentive to produce it. These dynamics result in the representation of a law of supply depicted by an upward-sloping curve while the law of demand is presented by a downward-sloping curve. The equilibrium price can be found at the point where the two curves intersect. This is the magical “clearing point” where all goods are sold. Price discovery is a common term in economics and finance to describe the process of determining the price of an asset by the interaction of buyers and sellers. It is a key function of a marketplace, even digital markets. When the “one price” is discovered, it leads to a clearing of the market.

An important concept in understanding prices is a product’s degree of elasticity. This refers to the influence of price changes on the quantities of product that are desired by consumers. Will a significant change in the price of buying a movie ticket influence audience attendance at theaters? And by how much? Will the launch of a new Apple iPhone that comes with a substantial price increase result in decreased sales, or will factors such as brand loyalty or customer captivity diminish the influence of the price increase? Understanding the elasticity of a product’s prices will tell us something about the sensitivity of that product’s market to changes in the price. A business can risk charging higher prices if the demand for the product’s price is inelastic. If it is elastic, a change in price is likely to result in major changes in consumption.

The pros and cons of markets are hotly debated today. Some believe markets are an ideal system to organize society. Proponents often cite Adam Smith’s famous “invisible hand” as the God-given mechanism that organizes a harmonious society based on market activity. But Smith only used the term once, at the end of The Wealth of Nations (1776) and was more focused on the production of economic activity by working people.

Others believe markets are prone to failure and give rise to unequal conditions and challenge democratic participation. It is no surprise that Karl Marx was a voracious reader of Adam Smith and his theories that the population was the source of economic wealth. Marx just didn’t think the people who did the work got a fair deal in the process of economic production. Marx believed that the conditions of capitalist markets meant that the wealth of economic activity went mainly to the owners of “the means of production” through profits. And the people doing the work were forced to compete against each other in the labor market, driving wages down. The following section looks at other concerns about markets from conteporary economists.

Evaluating the Market System: Pros and Cons

One of the best explanations of the strengths and weaknesses of the market system came from The Business of Media: Corporate Media and the Public Interest (2006) by David Croteau and William Hoynes. They pointed to the strengths of markets, such as efficiency, responsiveness, flexibility, and innovation. They also discuss the limitations of markets as well. These include enhancing inequality, amorality, failure to meet social needs, and the failure to meet democratic needs.[3]

The market provides efficiency by forcing suppliers to compete with each other and into a relationship with consumers that requires their utmost attention. The suppliers of goods and services compete with one another to provide the best products, and the competition among them forces them to bring down prices and improve quality. Firms become organized around cutting costs and finding advantages over other companies. They have immediate incentives to produce efficiencies as sales and revenue numbers from market activities provide an important feedback mechanism.

Responsiveness is another feature of markets that draws on the dynamics of supply and demand. Companies strive to adapt to challenges in the marketplace. New technologies and expectations, changes in incomes as well as tastes and preferences of consumers require companies to make alterations in their products, delivery methods, and retail schedules.

Likewise, consumers respond to new conditions in their ability to shop for bargains, find substitute goods, and adopt to new trends. Going online has meant new options for discovering, researching, and purchasing products. Combined with logistical innovations by companies like FedEx and TNT, ecommerce has shifted the consumption dynamic making it easier for customers to search for products, read the experiences of other consumers for that product, and have it delivered right to their homes.

Flexibility refers to the ability of companies to adapt to changing conditions. In the absence of a larger regulatory regime, companies can manufacture new products, new versions of products, or move in entirely new directions. In a market environment, companies can compete for consumers by making changes within their organizational structure, including adjustments in production, marketing, and finance.

Lastly, markets stimulate innovation in that they provide rewards for new ideas and products. The potential for rewards, and necessities of gaining competitive advantages, drive companies to innovate. Rewards can include market share, but also increased profits. Without competition, firms tend to avoid risk, an essential component of the innovation calculus, as many experiments fail.

Croteau and Hoynes and others point out serious concerns about markets that economists do not generally address. The tendency of markets to reproduce inequality is one important drawback to markets. While some inequality produces contrast and incentives to work hard or to be entrepreneurial, a society with a major divide between haves and have-nots will tend towards decreasing opportunities and incentives to work and innovate. Places with major divisions in wealth tend to be dystopic, a “sick” place. Sir Thomas More’s classic Utopia (1506) told of a mythical island where money was outlawed. Having gold was ridiculed and used for urinals and chains for slaves. It was a mythical place meant to be a social critique of inequalities of England. It denounced private property and advocated a type of socialism.

Thomas Piketty’s Capital (2015) addressed this issue of inequality head-on and warns that investment money gravitates towards more inequality. He targeted the trickle-down effects of capitalism and its tendency to lead to a slower and slower drip of money to those in the lower rungs. Neo-elites benefiting from the rolling back of the estate tax have advantages that others don’t have while often contributing less to the economy. We now have a generation inheriting money from their parents’ windfalls during the digital revolution.

“One dollar, one vote” is a common metaphor and an area of research to refer to the advantages the rich have over the poor. As they have many more dollars, the rich have many more votes to influence the political economy. Countries with a greater concentration of wealth at the upper incomes tend to have less progressive tax and welfare policies while countries with a richer poor tend to have a more government support for poorer people.

The second concern they have about markets is that they are amoral. Not necessarily immoral, but rather that the market system only registers purchases and prices and doesn’t make moral distinctions between, for example, human trafficking, drug trafficking, and oil trafficking. The commerce in a drug to cure malaria does not register differently from a recreational drug that provides a temporary physical stimulation (Illegal drugs are not registered in GDP). Markets do not judge products unless it registers changes in demand. It does not favor child care, healthy foods, or fuel-efficient cars, unless customers make their claims in currency via increased demand.

Can markets meet social needs? A number of services and sometimes goods should probably be provided by some level of government – defense, education, family care and planning, fire protection, food safety, law enforcement, traffic management, roads and parks. More complicated are issues related to electricity and telecommunications. A pressing question for the last thirty years has been the increasing privatization of activities that governments had actively engaged in. The telecommunications system for example, was considered a natural monopoly at first in order to protect its mission to provide universal telephone service, usually through government agencies called PTTs (Post, Telephone, and Telegraph) or through heavily regulated monopolies like AT&T in the US. Through the 1980s and 1990s, these entities were deregulated, opened to competition, and sold off to private investors. This allowed a global transformation to Internet Protocols (IP), but has challenged longstanding commercial traditions such as net neutrality and common carriage that restricts telecommunications and transportation organizations from discriminating against any customer.

Can markets meet democratic needs? Aldous Huxley warned of becoming a society with too many distractions, too much trivia, seeped in drugged numbness and pleasures. Because markets are amoral, they can become saturated with economic goods that service vices rather than public spirit. Competition, in this case, may result in a race to the lowest common denominator (sugar foods) rather than higher social ideals. Rather than political dialogue that would enhance democratic participation, the competition among media businesses tends to drive content towards sensationalist entertainment. This includes social media that allows participants to share information from a variety of news sources that are biased, one-sided, and often distorted.

Comedian Robin Williams once quipped, “Cocaine is God’s way of telling you that you are making too much money.” Markets provide powerful coordination systems for material production and creative engagement, but they also generate inequalities, often with products and services that are of dubious social value. How a society enhances and/or tempers market forces continues to be a major challenge for countries around the world.

For a market to function effectively, it needs several dynamics to succeed. One of the most important factors for a market to prosper is a successful currency. A medium of exchange will depend on trust in the monetary mechanism as buyers and sellers must readily accept and part with it. Money has had a long history of being things, most notably gold. Gold has striking physical attributes: it doesn’t rust, it doesn’t chip, and it can be melted into a variety of shapes. Other metals such as silver and platinum have also served as money. Credit cards, third party payment systems such as Paypal, and new digital wallets like Apple Pay and Samsung Pay provide new conveniences that facilitate economic transactions.

It is interesting that societies gravitate towards the use of some symbolic entity to facilitate these transactions. As discussed in the previous chapter, money can be anything that a buyer and seller agree is money. At times, commodities such as rice or tobacco and even alcohol have served the roles money. Market enthusiasts often overlook the importance of money, focusing instead on the behaviors of market participants. But money has proved to be central to market activities.

Summary

This essay explores the concept of markets in economics, highlighting their characteristics, the role of the price system, and the shift towards a mathematical understanding of markets with the concepts of equilibrium and marginal analysis. It also discusses the strengths and weaknesses of the market system, including its potential to enhance inequality, its amoral nature, and its limitations in meeting social and democratic needs.

The essay begins by defining markets as mechanisms that facilitate the exchange between buyers and sellers, emphasizing that they are social technologies that need to be created and managed. It then discusses the characteristics of markets, such as voluntary exchange, competition, and the use of a mutually acceptable means of payment.

The essay then delves into the price system, explaining how prices are determined by supply and demand and how they act as signals of scarcity and abundance. It also provides examples of dynamic pricing systems used by companies like Amazon.

It then discusses the shift from political economy to neoclassical economics, highlighting the contributions of William Stanley Jevons and Alfred Marshall in developing the concepts of equilibrium price and marginal analysis. This shift led to a more mathematical and technical approach to economics, focusing on market mechanics rather than broader social and political factors.

Finally, the essay evaluates the strengths and weaknesses of the market system, drawing primarily on the work of David Croteau and William Hoynes. It discusses the efficiency, responsiveness, flexibility, and innovation fostered by markets, but also acknowledges their potential to enhance inequality, their amoral nature, and their limitations in meeting social and democratic needs.

In summary, the essay provides an overview of the concept of markets in economics, highlighting their characteristics, the role of the price system, the shift towards a mathematical understanding of markets, as well as the ongoing debate about their strengths and weaknesses.

Notes

[1] Jevons, W. S. (1871) The Theory of Political Economy. Macmillan and Co.

[2] Marshall, A. (1890) Principles of Economics. Macmillan and Co.

[3] Croteau, D. and Hoynes, W. (2006) The Business of Media: Corporate Media and the Public Interest (2006).

Citation APA (7th Edition)

Pennings, A.J. (2025, Feb 23) Markets and Prices: Pros, Cons. apennings.com https://apennings.com/dystopian-economies/markets-and-prices-pros-cons/

© ALL RIGHTS RESERVED

Anthony J. Pennings, PhD is a professor in the Department of Technology and Society, State University of New York, Korea and holds a joint appointment as Research Professor at Stony Brook University. He teaches AI policy and digital economics. From 2002-2012, he taught digital media economics and information systems management at New York University. He also taught in the MBA program at St. Edwards University in Austin, Texas, where he lives when not in Korea.

Anthony J. Pennings, PhD is a professor in the Department of Technology and Society, State University of New York, Korea and holds a joint appointment as Research Professor at Stony Brook University. He teaches AI policy and digital economics. From 2002-2012, he taught digital media economics and information systems management at New York University. He also taught in the MBA program at St. Edwards University in Austin, Texas, where he lives when not in Korea.

Tags: Alfred Marshall > Bloomberg box > Reuters Monitor > William Stanley Jevons